Consultant story

Simmi Bajaj, Cynozure Associate, shares how we approached value creation with a new data and insights guided analytics team at Studio Retail.

The value created from a new data and insights driven analytics team

Studio Retail is an established and multi channel retailer that has been in operation for 50 years. The recent digital transformation has seen digital account for 90% of sales, up from 50% in 2016. With digital transformation comes the opportunity to move to a more data centric enterprise and Studio Retail recognised the value in putting data at the heart of everything that it does; so what followed was a significant investment in building the capabilities of the Enterprise Data Team, harnessing the millions of records in first party data collected from Studio Retail customers.

Working alongside the rest of the Cynozure and Studio Retail team, my responsibility was to lead and own the data and analytics products for the marketing team – a specialist business unit ‘spoke’ within the Enterprise Data team ‘hub’. It’s an interesting position to be in, as there is a balance and synergy with being both product and customer focused.

A lot of information that existed in Studio Retail was in the form of reports that were created depending on the platform that the data was available in. My task was a bit like a gardener, I had to wade through the existing garden, do some weeding to focus on the reports and analysis that I really needed, and ultimately unearth some gems (or beautiful blooms!) to deliver insights that were actionable.

The garden was the product that I wanted to create, using various (gardening) tools to weed, trim, nourish and plant.

I took a 3 step approach to produce Studio’s beautiful data and analytics garden

Step 1

I looked for insights; little nuggets that told a story, in and amongst the plethora of data and reporting that existed in the business.

I trawled through more than 50 reports, assessed all the new requests coming into the business and spoke to stakeholders about what their objectives were.

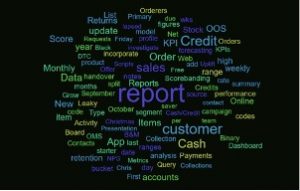

I was curious to summarise all the existing requests in a way that I could talk about so I produced this word cloud of all business requests, which gave me a quick insight into the type of work coming into the team.

It was clear that the work the team was doing was very report focused, understandably as the tools and infrastructure for more complex analysis were being put in place but not there just yet. But we were looking to change the mindset to be more customer focused and to pivot our analysis and thinking to cover more deep dive customer analytics. This takes time, requires the right resource and the right tools. So whilst I worked on those I started to unpick reports and looked for gems.

Here are a few gems:

- When looking at orders and customer service pre and post lockdown, we saw a shift in when customers place orders, and when they contact the call centre. This insight helped the customer service teams with planning and resourcing during lockdown

- We built a report to track customer movements into and out of the base – ie acquisitions, and lapsers. Whilst this is still a report, it helped us to add more focus to our existing base and has added renewed interest to focusing on customer retention in the business; the value attached to reactivating just 3% of a large lapsed customer base is in the many millions of pounds

- Customer retention when items are out of stocks – interesting piece of work that showed that if a customer had a cancelled order as a result of an item being out of stock, their retention was mostly driven by whether they were a cash customer or if they were a new customer (retention good for credit customers despite negative order experiences). As a result the business got clarity on where to invest in goodwill gestures to protect customer retention when stock issues resulted in bad experiences

- Segment deep dive – one of the customer segments appeared to be decreasing in size year on year despite it being one of the original growth segments. The deep dive analysis showed that the majority of customers in this segment were incentive driven and incentives played a much smaller part in the overall strategy in 2020 than 2019. There are now plans to create bespoke segment specific incentives for this segment to retain them year on year

Step 2

Whilst doing the weeding and finding hidden gems in the garden, I sowed the seeds for an insight driven culture by planting the importance of the ‘so what’ in everything we deliver. This is an art and requires a right brain approach to the usually left brained analyst thinking. With the right nudges and reminders though, this can be achieved and is essential to establish before new talent and tools are brought in.

An insights guided culture also requires establishing best practices throughout the enterprise. Studio Retail spends a significant amount of money on incentivising customers to join up on a credit account. Various incentives have been tried out in the business and , we will now be testing two offers head to head against a control group so we should get a very accurate picture of the incremental benefit of having an offer and also which offer drives the highest conversion. These best practices are essential for data guided decision making in any business.

Step 3

Thirdly we were keen to improve how people received the insights they deserved by reviewing processes, and ‘nourishing’ and refining them along the way. All requests were to be channelled through one person, the lead in order to provide the best knowledge on the business background for all analytical requirements. Once all new work was logged in a system (Microsoft Planner), work could be prioritised and shared across the team so workloads became transparent and output was regularly measured.

The flowers are now starting to spring up in Studio Retail’s data and analytics garden

- The garden is there for all to view – there is transparency across the teams on what is being worked and output is measured weekly

- The garden can be admired because of its ‘best in class’ features – we are embedding best practices across the teams, such as AB testing with control groups, deep dive analytics to uncover underlying trends that are not always visible

- Retention has been firmly planted in the garden as a priority to review in Financial Year 2022. A new report called a Leaky Bucket has given us a new retention lens on the business, and we’re now talking more about customer retention and how this can be reviewed in the future alongside all the acquisition plans

- We have four new analysts in the team, that were recruited because of their insightful abilities, they join the existing insights guided analytics team to work in an insights guided culture. The complete team of analysts will flourish in the team with their desire to cultivate insights at Studio Retail.

It’s been great to see the marketing spoke blossom early on in the data journey at Studio Retail and help to demonstrate what is possible. I’m pleased this will go a long way to cultivate the wider data strategy agenda that Studio Retail and Cynozure are working on together.

See what Ed Child, Head of Enterprise Data at Studio Retail, had to say in our customer case study

Related.

See all

Cynozure research calls for stronger data leadership in US financial firms to unlock data benefits

A CLEAR™ Path: How to Foster a Robust Data Culture by Leveraging Concepts from Industrial and Organizational Psychology

Outsmarting the Bots on demand: A practical application of machine learning